Introduction

The SBI Cashback Credit Card is one of the most attractive options for avid online shoppers in India. With generous cashback rates and straightforward redemption, it caters to those who frequently spend on e-commerce platforms. However, like any financial product, it comes with its own set of advantages and limitations. This honest review will help you decide if the SBI Cashback Credit Card is the right fit for your lifestyle and spending habits.

Key Features of the SBI Cashback Credit Card: Cashback Benefits

- 5% Cashback on eligible online spends (up to ₹1,00,000 per month).

- 1% Cashback on all other spends, including offline transactions.

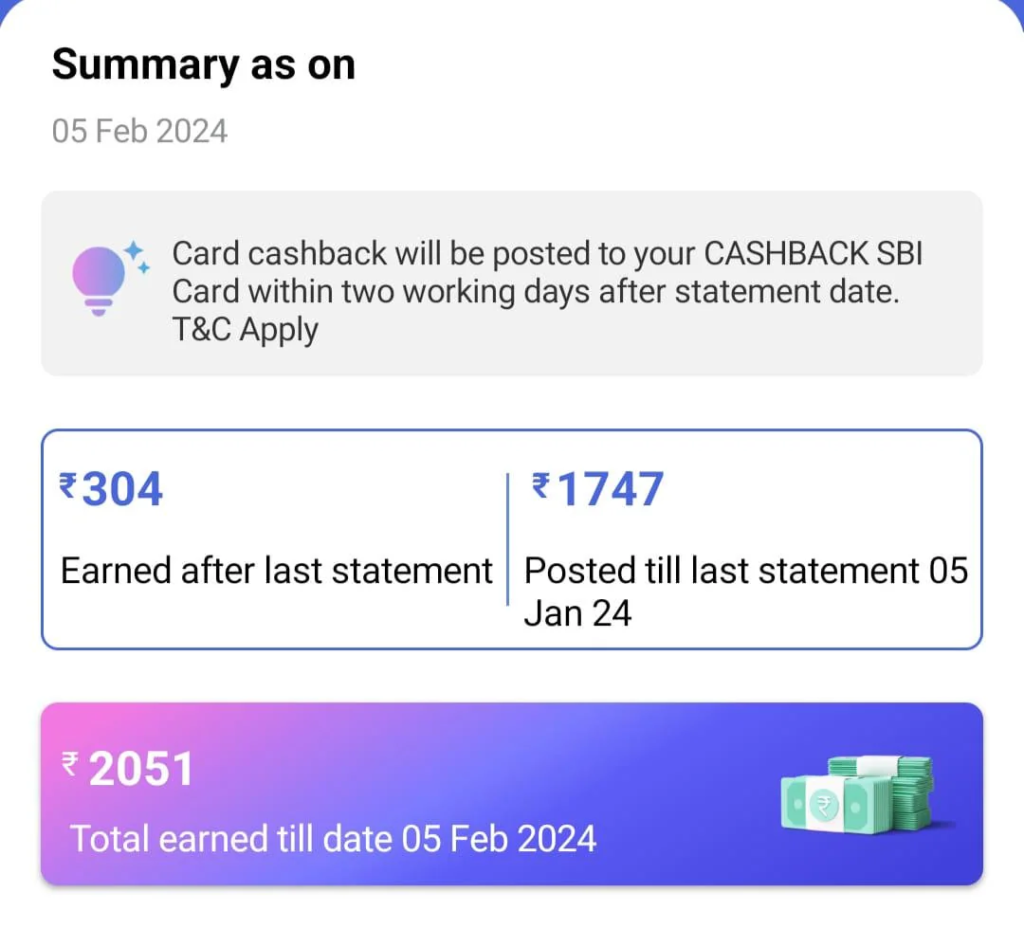

- Cashback is credited as a statement credit two days after the generation of the monthly statement.

Annual Fee:

- ₹999 (waived off if annual spending exceeds ₹2,00,000).

Contactless Payments:

- Tap-and-pay for transactions under ₹5,000 without the need for a PIN.

Zero Joining Benefits:

- Unlike many cards, this one does not offer any welcome rewards, which may deter some users.

Benefits for Online Spenders: Why It’s Ideal for E-Commerce Enthusiasts:

- Higher Cashback Rates: At 5% cashback on online spends, it’s one of the most competitive rates in the market.

- No Merchant Restriction: Most popular online shopping platforms are covered, including:

- Amazon

- Flipkart

- Myntra

- Tata Neu

Maximizing Your Savings:

- Use the card for all eligible online purchases, including shopping, subscriptions, and travel bookings.

- Leverage Amazon Pay and Tata Neu App Purchases:

- Earn 5% cashback on Amazon Pay Gift Voucher (GV) purchases made directly from Amazon India app/website.

- Use Amazon Pay GV for utility bill payments and other expenses to indirectly earn cashback.

Comparative Advantage:

- Outperforms many co-branded cards like Flipkart Axis and Myntra Kotak.

- Offers more flexibility compared to Amazon Pay ICICI Bank credit card, which requires Prime membership for 5% cashback.

Downsides to Consider:

- Small Initial Credit Limit:

- Many users report receiving a low initial credit limit, especially if they already have an SBI card with a substantial limit nearing ₹5 lakh.

- Cashback Tracking Issues:

- Matching cashback with transactions can be challenging.

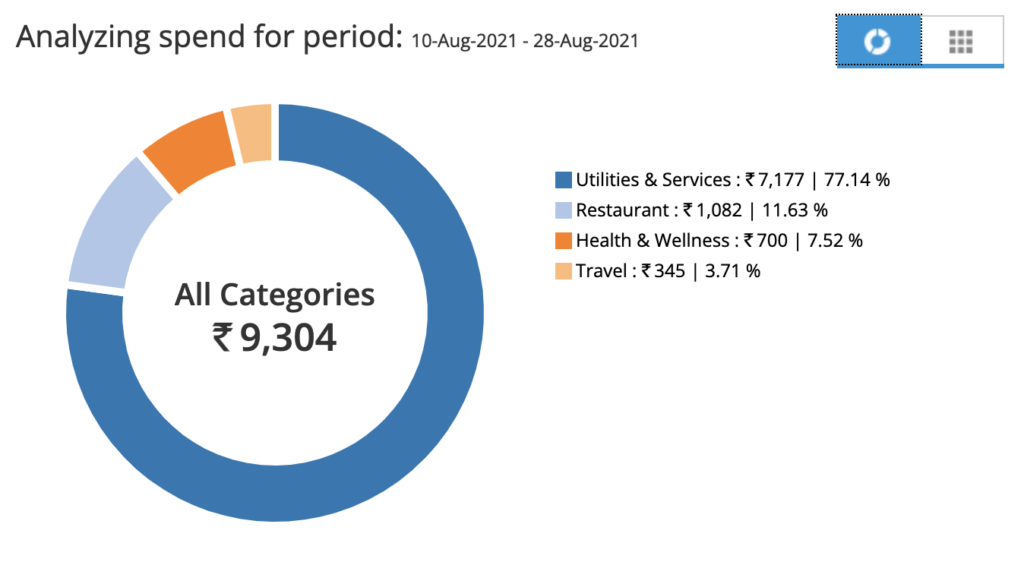

- The SBI Spend Analyser (on SBI netbanking desktop) tool can help reconcile your spends, but it requires manual effort to look at transaction / merchant categories

- Customer service may not always provide effective resolution for discrepancies.

- Devaluation in May 2023:

- Removed airport lounge access.

- Increased exclusion categories for cashback.

To track all categories/ merchants that provide cashback on SBI Cashback Card, please refer to this compilation: SBI Cashback Card merchant wise cashback

How to Maximize Returns:

- Spend Strategically:

- Use the card for online purchases up to ₹1,00,000 monthly to earn the maximum cashback of ₹5,000.

- Leverage Spend Categories:

- Focus on e-commerce platforms with 5% cashback.

- Use Amazon Pay and Tata Neu app purchases strategically.

- Avoid Excluded Categories:

- Excluded categories include direct utility bill payments, fuel spends, and government transactions.

- Workaround: Purchase e-wallet vouchers to ensure cashback eligibility.

- Keep Track of Your Spends:

- Regularly use the SBI Spend Analyser to monitor cashback-eligible transactions.

Verdict: Is It Worth It? The SBI Cashback Credit Card remains an excellent choice for online shoppers who can maximize its 5% cashback benefits. Despite some limitations like a low initial credit limit and reduced benefits post-devaluation, the card offers substantial savings for frequent e-commerce shoppers.

By strategically planning your transactions, avoiding excluded categories, and leveraging gift voucher purchases, you can significantly reduce your overall spending and maximize cashback returns.

Leave a Reply