Axis Bank is once again in the spotlight due to its recent actions on EDGE Rewards. On December 14, 2024, numerous Axis Bank credit cardholders reported significant reversals of EDGE Reward Points without prior notice. This move has sparked frustration, especially among those who rely on these points for premium card benefits and partner redemptions.

What Happened?

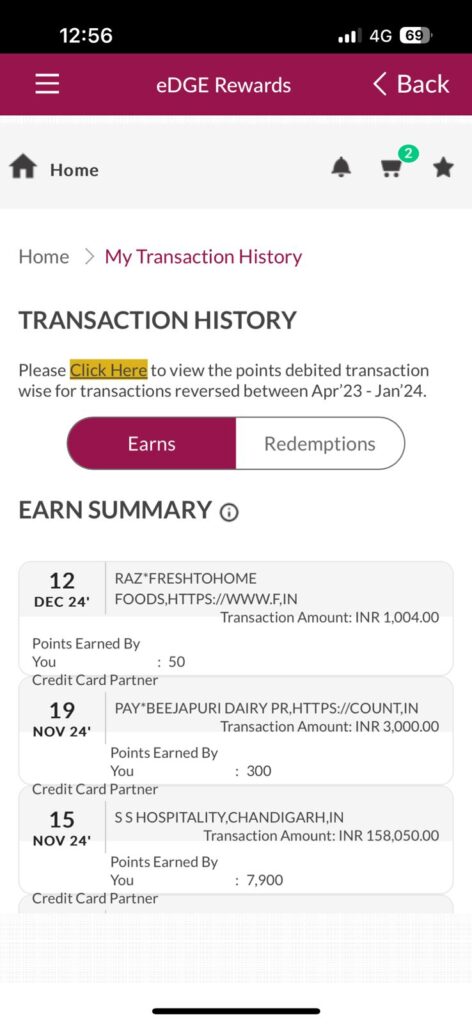

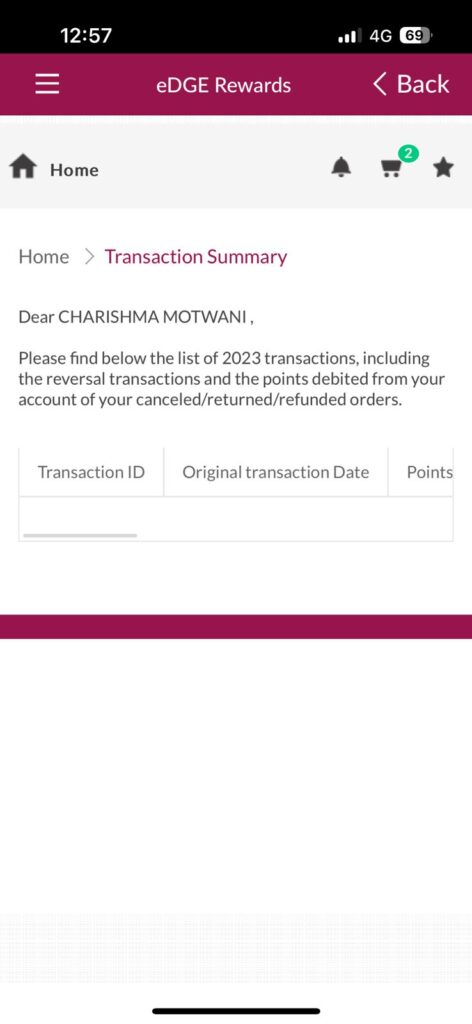

According to reports, Axis Bank reversed reward points earned from specific transactions, citing a “technical recalibration” in its rewards system. Many affected customers noted reversals even for legitimate transactions, leading to unexpected negative balances in their EDGE Rewards accounts. This followed Axis Bank’s broader revision of reward structures and fees effective from December 20, 2024.

Why Were Points Reversed?

Axis Bank stated that the reversal was part of a system correction:

- Technical Errors: Points credited for ineligible transactions were reclaimed.

- Fraudulent Activity Checks: Certain flagged transactions, such as those processed through loopholes, led to retroactive adjustments

Customer Backlash

Cardholders have voiced their dissatisfaction on platforms like Reddit an TechnoFino, citing:

- Lack of Transparency: Customers were not informed about the reversal process in advance

- Impact on Partner Transfers: Negative balances disrupted redemptions, particularly for premium partner programs like Magnus EDGE and Burgundy

- Rushed Implementations: Some users believe the changes were executed without considering genuine usage scenarios

How to Respond?

If you’re an affected Axis Bank credit cardholder, here’s what you can do:

- Verify Transactions: Check your credit card statements and EDGE Rewards balance to identify reversed points.

- Contact Customer Care: Reach out to Axis Bank to request a detailed explanation and recalculation.

- Raise a Complaint: If unresolved, escalate the issue through the RBI Ombudsman Complaint Management System portal with all supporting documents.

- Adjust Spending Strategies: Monitor rewards policies and focus on categories that offer assured points without ambiguity.

What This Means for Axis Bank Users

This incident highlights the risks of opaque reward systems. With ongoing policy changes—such as new redemption fees and altered reward rates—it’s crucial for customers to stay informed and act swiftly when discrepancies arise.

Leave a Reply